Context and Opportunity

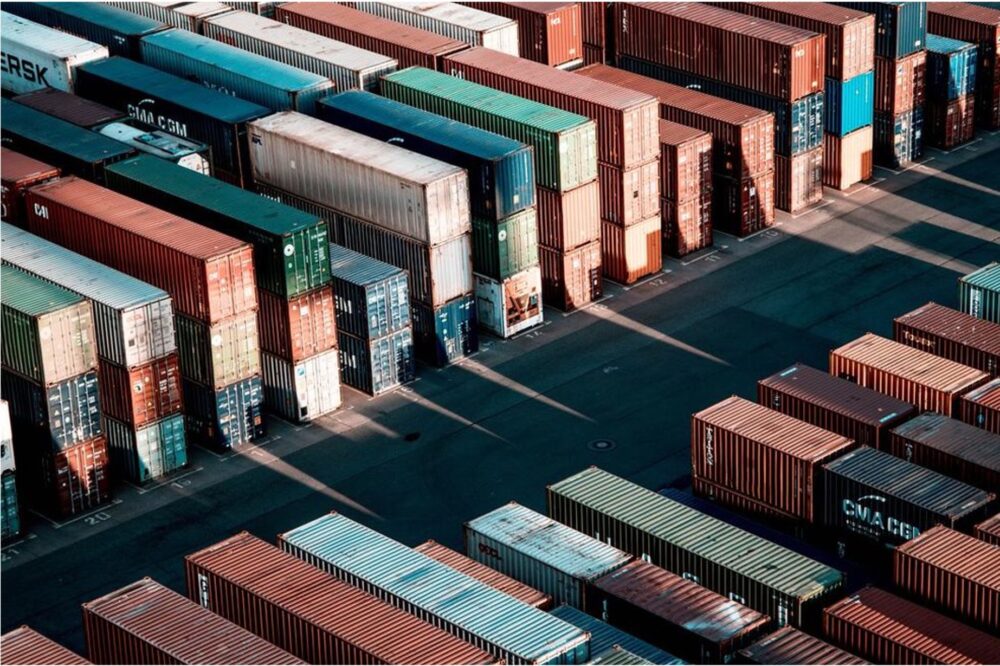

ASEAN’s trajectory is being reshaped by three major geoeconomic shifts: overcapacity and surges in industrial output, the reorganization of global trade alliances, and a more fragmented economy that challenges cross-border cooperation. Together, these forces are fragmenting trade, redirecting investment, and accelerating industrial policies that prioritise security and resilience over efficiency. These are creating both risks and opportunities that impact ASEAN, making it critical to understand their implications in detail.

Growth Gateway equipped ASEAN with 15 clear priority areas to mitigate and respond to geoeconomic impacts. If combined with enabling reforms, advancing these priorities could generate GBP 2.2–3 Trillion in GDP uplift, nearly matching the size of ASEAN’s current economy. These areas include, among others, addressing non-tariff barriers, digitising trade activity, unlocking critical global value chains, opening new markets, and deepening industrial cooperation.

Key Highlights

Value at risk

£1.4T

Trade value exposed due to geoeconomic shifts

Business voices

100+

Private sector consulted through surveys, interviews and roundtables

Value at stake

£3T

In GDP uplift due to advancing the 15 priorities identified with enabling reforms

Growth Gateway worked with the ASEAN Secretariat and the ASEAN Geoeconomic Task Force (AGTF) to strengthen ASEAN’s resilience to geoeconomic shifts.

This work has equipped ASEAN with a clear roadmap to reinforce competitiveness and resilience, while also elevating the UK’s role as a trusted strategic partner on resilient value chains and geoeconomics. By combining the region’s priorities with UK’s expertise, it has reinforced strategic multi-lateral government ties and created a platform for long-term trade, investment, and policy collaboration.

Support Provided

Provide a diagnostic assessment of geoeconomic implications

Analysed geoeconomic impacts across three key shifts:

- Overcapacity and surges in industrial output: $740B of potential trade diversion from key partners

- Reconfiguration of economic blocs: $1.5T in projected ASEAN export volume to key trade corridors

- Economic fragmentation: $68B in total incremental impact on ASEAN-US exports

- Concluded that ASEAN stands to lose $0.7-1.5T in trade and $50-110B in investment as a result of mounting geoeconomic shifts

Brought the private sector voices to the table

Conducted engagement sessions with ASEAN and UK businesses through:

- Business roundtables attended by 50+ senior executives and ASEAN business leaders

- Private sector survey of 100+ business respondents

- In depth expert interviews with senior executives to understand main challenges and policy prioritiesSet up platform for offtake and financing solutions

Identified 15 priorities with six starting points for ASEAN

Surfaced six starting points amongst 15 high impact priorities to deliver in the short term. ASEAN can realise progress that directly addresses private sector concerns, builds confidence in the region’s competitiveness, and lays the foundation for longer-term resilience.

Combined with enabling reforms, advancing these fifteen priorities could generate GBP 2.2–3 Trillion in GDP uplift, nearly matching the size of ASEAN’s current economy.

We liked Growth Gateway presentation on how we don’t just need to think about tariffs, but also need to strengthen the non-tariff measures, such as standards

–Indonesia representative to AGTF

Impact Achieved

8 Priority Sectors

identified as both most impacted and most strategically vital, including automotive, consumer electronics, energy, and metals

15 Priorities Identified…

…with 6 Ambitions for ASEAN

in the short-term to strengthen and build sustainable long-lasting resilience

To find out more about our impact, follow Growth Gateway on Linkedin or contact us