Growth Gateway supported Oze in securing £4M in financing

Getting that loan from Oze was key! With the funds, I didn’t just fill my inventory, I completely energised my entire operation. This smart investment enabled me to respond lightning-fast to market demands.

Phliipa

Business owner, Ghana

Phliipa‘s story

Before Oze

As a small business owner, Philipa struggles to access affordable loans. Without the tech to track years of financials, she turns to informal lenders with high interest—limiting her growth

After Oze

With Oze, Phliipa now keeps a digital record to build credit history. She can access loans at as low as 3% monthly, allowing her to grow her business by investing where she couldn’t before

Oze’s impact

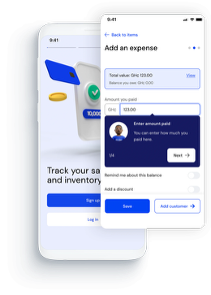

Oze enables small & medium enterprises (SMEs) to access affordable loans by building credit histories and providing lenders with the tools to assess risk. SMEs have already accessed nearly £1.8 million in financing, transforming informal enterprises into data-driven, financially confident businesses

Startups Supported

300,000

SMEs on Oze platform

Challenge

Oze achieved strong early traction with its bookkeeping platform but needed support to scale its lending model, strengthen unit economics, and build investor confidence for expansion into new markets

As the company transitioned from early adopters to broader SME segments, it also needed a clear, data-backed narrative to differentiate itself and attract growth-stage capital

We explicitly wanted to work with Growth Gateway, because they possess the market expertise needed to convince investors of the opportunity in East Africa

Meghan McCormick

Founder & CEO, Oze

Gateway’s Role

Oze was supported through Growth Gateway’s Women’s Economic Empowerment Accelerator, which helps startups unlock investment

- Validating go-to-market strategy for new products in West Africa

- Refining investor materials to attract growth-stage capital

- Identifying mission-aligned partners and investors

- Valuing women’s economic empowerment impact metrics to strengthen investor confidence

To find out more about our impact, follow Growth Gateway on Linkedin or contact us